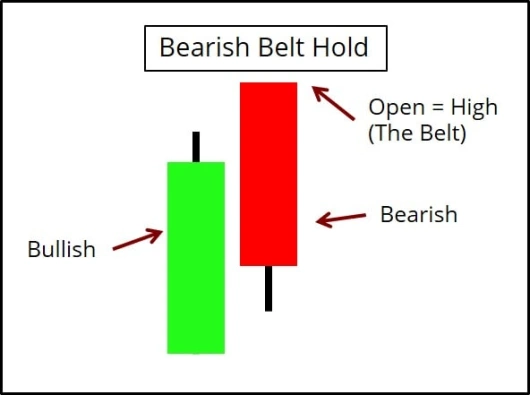

Bearish Belt Hold

Although price will reverse frequently after the candle appears price usually does not drop far as the overall performance rank attests.

Theoretical performance: Bearish reversal

Price opens at the high for the day and closes near the low, forming a tall black candle, often with a small lower shadow.

If you are looking for a trading setup, then that is what you should search for: the candle to appear at the top of a retrace against the prevailing price trend.

Essential conditions

-The belt hold candlestick does not trade higher than its opening price. (i.e., no upper shadow)

-The belt hold candlestick must be bearish.

-The previous candlestick must be bullish.

Optional conditions

-The belt hold candlestick must close within the body of the previous candlestick.

-The belt hold candlestick should close near its low. (i.e., little lower shadow)

-The belt hold candlestick must open higher than the high of the previous candlestick.

What we're going to look at now is some bearish candlestick pattern movements in particular a two day pattern called the bearish belt hold. Now what we note over these two days starting with the green candlestick on day one is a very small amount of price movement that's represented by the small green body then the bearish belt hole pattern really starts to take place with this big long red candlestick. Now the red candlestick always starts at the top of the body now note there's no wick above where it opens so it hasn't tested the waters right up above where it opened it was pretty much open and then bad news right down to the bottom of the wick that's the lowest price that got to for the day but it did come back a little bit and then settled and closed at the bottom of that body.

Now you'llnote that the red candlestick is up higher and opens well in excess of where the price action was on day one it completely overwhelms it now let's go to share prices.com day you now and have a look at this candlestick chart over a couple of months and see if we can spot the bearish belt holding there it is over on the left now you'll note that it moves right up to that point and the red candlestick on day two of the bearish belt hole pattern is the highest point that it got up to throughout that week leading up and then about the week leading down.

Let's have a look at the formation again, day 1...small green candlestick then completely overwhelmed right up the top here with the beginning of the price movement for day 2, then falls right down so it's a two day pattern but a little hint on a short-term pattern that it's on the move down after rising up to that level and it's true to form. Look at that moves right up to the highest point on the red candlestick day 2 of the bearish pattern, then starts to fall away over two three four days and then picks back up again and eventually starts to move right up to this top right hand corner but it's a short-term pattern and it's hinting that over those a couple of days things are on the move it's built up to a point and then maybe on the way back down again which is true for this and there is the form once more day one as Green Day to red way up in excess of where it was on day 1.